Stash Review: We Tested The App That Is Simplifying Investing For Everyone From Newbies To Pros

When it comes to investing, simply starting is often the hardest part. A lot of traditional investment brokerage firms require hefty account minimums and expert portfolio management that can cost you thousands in fees. Figuring out where to go to begin your investing journey — or if you’ve already started, if you are using the right platform to invest — isn’t typically easy.

Thankfully, some companies in fintech space are now aiming to make investing easier and more affordable — and Stash is one of them. In this article, we’ll give you a complete rundown of this popular investing app. We’ll cover everything from how it works and what it has to offer investors, to how to best take advantage of its various features and who is best suited to use this app.

Investment

Stash investment accounts are personal (taxable) brokerage accounts. Users can build their own investment portfolios by choosing from the app’s nearly 2,000 stocks and ETFs and manage their investments themselves.

Retirement

Beyond brokerage accounts, Stash offers Roth IRA and traditional IRA accounts.3 You can open an IRA account with an initial contribution as small as $.01.2

Custodial

Users can open up to two Stash investment accounts4 on behalf of children under the age of 18 and when those children are of age, they can take over the accounts. This can be a great way for parents to start teaching their children about the power of investing early and to save for their future education. Of note, anyone qualified can open a custodial account for a child, you don’t need to be a parent.

Banking

Stash subscribers are offered a bank account.5 There are no overdraft10, monthly maintenance or minimum balance fees11 for the account and users get access to thousands of fee-free ATMs.12 It comes with a debit card with Stock-Back® rewards — cash back in the form of stocks or ETFs — when you spend at places like Amazon, Costco, CVS, Apple and more.6 When users set up a direct deposit, they get access to their paycheck up to two days early13 and can get rewarded with a $50 bonus to put towards investing.7 Stash also lets you move money automatically into your Stash Banking account from your external bank account through recurring transfers.9

Investment

Stash investment accounts are personal (taxable) brokerage accounts. Users can build their own investment portfolios by choosing from the app’s nearly 2,000 stocks and ETFs and manage their investments themselves.

Retirement

Beyond brokerage accounts, Stash offers Roth IRA and traditional IRA accounts.3 You can open an IRA account with an initial contribution as small as $.01.2

Custodial

Users can open up to two Stash investment accounts4 on behalf of children under the age of 18 and when those children are of age, they can take over the accounts. This can be a great way for parents to start teaching their children about the power of investing early and to save for their future education. Of note, anyone qualified can open a custodial account for a child, you don’t need to be a parent.

Banking

Stash subscribers are offered a bank account.5 There are no overdraft10, monthly maintenance or minimum balance fees11 for the account and users get access to thousands of fee-free ATMs.12 It comes with a debit card with Stock-Back® rewards — cash back in the form of stocks or ETFs — when you spend at places like Amazon, Costco, CVS, Apple and more.6 When users set up a direct deposit, they get access to their paycheck up to two days early13 and can get rewarded with a $50 bonus to put towards investing.7 Stash also lets you move money automatically into your Stash Banking account from your external bank account through recurring transfers.9

In the app’s “Learn” tab, users can find a robust offering of educational materials, including explainer articles on investing basics like “Stocks vs. Shares: Everything You Need to Know” and “Everything You Need to Know About DRIP,” to more complex topics like “Investing Lessons From Warren Buffet” and “Foreign Stocks: Should You Invest in Them?” Stash also publishes similar articles for other areas of finance like debt management and credit. In the “Learn” tab, users can find the latest finance and investing news, access a glossary of investing and finance terminology, learning guides, fun quizzes, Stash’s money lifestyle blog, a personal finance podcast, and more.

Stash Coach, the app’s personalized financial coaching tool, is designed to help users grow their investing knowledge and build well-balanced and diversified portfolios. Based on a user’s level of experience and risk tolerance indicated at sign up, they’ll get weekly challenges that are geared towards helping them achieve their investing goals. Users earn points from their challenges that they can later look back on to see their progress.

In the app’s “Learn” tab, users can find a robust offering of educational materials, including explainer articles on investing basics like “Stocks vs. Shares: Everything You Need to Know” and “Everything You Need to Know About DRIP,” to more complex topics like “Investing Lessons From Warren Buffet” and “Foreign Stocks: Should You Invest in Them?” Stash also publishes similar articles for other areas of finance like debt management and credit. In the “Learn” tab, users can find the latest finance and investing news, access a glossary of investing and finance terminology, learning guides, fun quizzes, Stash’s money lifestyle blog, a personal finance podcast, and more.

Stash Coach, the app’s personalized financial coaching tool, is designed to help users grow their investing knowledge and build well-balanced and diversified portfolios. Based on a user’s level of experience and risk tolerance indicated at sign up, they’ll get weekly challenges that are geared towards helping them achieve their investing goals. Users earn points from their challenges that they can later look back on to see their progress.

The questions that follow help Stash get an understanding of a user’s financial situation so that it can adequately advise and support users during their investing journey with the app. They’ll be asked about their employment status, what type of work they do, how much income they earn and their approximate net worth, when they think they’ll use the money they’re investing, their marital status, if they have kids or own a home, their level of investing experience, if they have a retirement account, and more. It seems like a lot, but it’s actually pretty easy to sail through these questions.

After that, users can decide how much they would like to invest each week or they can choose to make a one-time investment.

Then users start to choose their investment mix–choosing between Stash’s offerings of stocks and ETFs.

From there, users are asked to link their bank account to pull the initial investment and the app’s fees from.

That’s it, after that, the sign-up process is done.

Once signed up, whenever users open up the app, they’ll be in the “Home” tab where they get an overview of their account activity. They’ll be able to see the total value of their investments and cash in all of their Stash accounts. So, if a user has an investment account, a Stash Banking account, and a retirement account, they’ll be able to see the complete total of all three of those accounts. Users will also be able to see the total value of their investment portfolio and the amount of money in their Stash Banking account separately.

In the “Spend” tab, users can manage their Stash Banking account and see its activity. In the “Invest” tab, they can explore both individual company stock and ETF options. In the “Auto-Stash” tab, they’ll be able to manage all of the automated savings and investing features of the app. In the “Learn” tab, they can access the app’s full library of educational materials.

The questions that follow help Stash get an understanding of a user’s financial situation so that it can adequately advise and support users during their investing journey with the app. They’ll be asked about their employment status, what type of work they do, how much income they earn and their approximate net worth, when they think they’ll use the money they’re investing, their marital status, if they have kids or own a home, their level of investing experience, if they have a retirement account, and more. It seems like a lot, but it’s actually pretty easy to sail through these questions.

After that, users can decide how much they would like to invest each week or they can choose to make a one-time investment.

Then users start to choose their investment mix–choosing between Stash’s offerings of stocks and ETFs.

From there, users are asked to link their bank account to pull the initial investment and the app’s fees from.

That’s it, after that, the sign-up process is done.

Once signed up, whenever users open up the app, they’ll be in the “Home” tab where they get an overview of their account activity. They’ll be able to see the total value of their investments and cash in all of their Stash accounts. So, if a user has an investment account, a Stash Banking account, and a retirement account, they’ll be able to see the complete total of all three of those accounts. Users will also be able to see the total value of their investment portfolio and the amount of money in their Stash Banking account separately.

In the “Spend” tab, users can manage their Stash Banking account and see its activity. In the “Invest” tab, they can explore both individual company stock and ETF options. In the “Auto-Stash” tab, they’ll be able to manage all of the automated savings and investing features of the app. In the “Learn” tab, they can access the app’s full library of educational materials.

Footnotes

Table Of Contents

What Is Stash? Stash’s Investment Options Stash’s Account Offerings Stash’s Features How Much Does Stash Cost? Signing Up & Navigating The App Where Stash Shines Is Stash The Best Investment App For You?

What Is Stash?

Stash offers 3,806 stocks and 218 ETFs1 (baskets of investments bundled into a single fund) for users to pick from to build their investment portfolios. Users can start investing for as low as $1. That is made possible because they can invest with fractional shares (less than a whole share of a stock, bond or ETF), as well as individual stocks. Fractional shares are available to users for all investments in the app and can be bought starting at as low as 1 cent.1 For investments priced at more than $1,000 per share, the purchase of fractional shares starts at 5 cents. While Stash doesn’t manage user investment accounts directly, it does provide a comprehensive and ever-evolving library of educational materials and in-app tools to guide users throughout their investing journey.Stash’s Investment Options

As we mentioned above, Stash currently offers 3,806 stocks and funds for its users to invest in and allows users to invest with fractional shares. Investments in the app are organized and named based on sector, company mission and causes, and investment risk level. In the app, stocks and funds are divided into two categories: “Companies” and “ETFs”. In the “Companies” category, you can find stocks organized by the various sectors of the economy, like “Consumer Staples”, “Energy” and “Finance”. In “Consumer Staples”, you’ll find global consumer-focused brands including food and beverage companies. In “Energy”, there are large oil and gas companies. In “Finance” you’ll find major players in financial services (including both government and non-government institutions). In the ETFs category, funds are organized by economy sectors, as well as themes, like “Bonds”, “Technology and Innovation” and “Missions and Causes”. In “Bonds” are ETFs made up of various types of bonds. For example, in the ETF titled “Public Works” are municipal bonds, which are used by cities and states to fund important building projects and day-to-day operations of local governments. In “Technology and Innovations” are ETFs with companies that work in technology. There you can find an ETF titled “Internet Titans”, which has companies that provide internet-related services. In “Missions and Causes” are ETFs with companies that are environmentally and socially conscious. In the ETF titled “Do the Right Thing”, there are for-profit companies that also work to make positive impacts on environmental, social and governance issues.Stash’s Account Offerings

Investment

Stash investment accounts are personal (taxable) brokerage accounts. Users can build their own investment portfolios by choosing from the app’s nearly 2,000 stocks and ETFs and manage their investments themselves.

Retirement

Beyond brokerage accounts, Stash offers Roth IRA and traditional IRA accounts.3 You can open an IRA account with an initial contribution as small as $.01.2

Custodial

Users can open up to two Stash investment accounts4 on behalf of children under the age of 18 and when those children are of age, they can take over the accounts. This can be a great way for parents to start teaching their children about the power of investing early and to save for their future education. Of note, anyone qualified can open a custodial account for a child, you don’t need to be a parent.

Banking

Stash subscribers are offered a bank account.5 There are no overdraft10, monthly maintenance or minimum balance fees11 for the account and users get access to thousands of fee-free ATMs.12 It comes with a debit card with Stock-Back® rewards — cash back in the form of stocks or ETFs — when you spend at places like Amazon, Costco, CVS, Apple and more.6 When users set up a direct deposit, they get access to their paycheck up to two days early13 and can get rewarded with a $50 bonus to put towards investing.7 Stash also lets you move money automatically into your Stash Banking account from your external bank account through recurring transfers.9

Investment

Stash investment accounts are personal (taxable) brokerage accounts. Users can build their own investment portfolios by choosing from the app’s nearly 2,000 stocks and ETFs and manage their investments themselves.

Retirement

Beyond brokerage accounts, Stash offers Roth IRA and traditional IRA accounts.3 You can open an IRA account with an initial contribution as small as $.01.2

Custodial

Users can open up to two Stash investment accounts4 on behalf of children under the age of 18 and when those children are of age, they can take over the accounts. This can be a great way for parents to start teaching their children about the power of investing early and to save for their future education. Of note, anyone qualified can open a custodial account for a child, you don’t need to be a parent.

Banking

Stash subscribers are offered a bank account.5 There are no overdraft10, monthly maintenance or minimum balance fees11 for the account and users get access to thousands of fee-free ATMs.12 It comes with a debit card with Stock-Back® rewards — cash back in the form of stocks or ETFs — when you spend at places like Amazon, Costco, CVS, Apple and more.6 When users set up a direct deposit, they get access to their paycheck up to two days early13 and can get rewarded with a $50 bonus to put towards investing.7 Stash also lets you move money automatically into your Stash Banking account from your external bank account through recurring transfers.9

Stash’s Features

Portfolio Builder

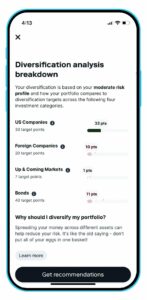

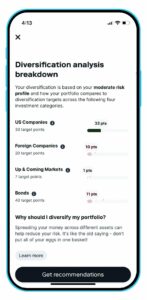

Stash users can enlist the help of this tool during sign-up to help them instantly build a portfolio. Based on the risk level a user indicates during account set up — conservative, moderate or aggressive — Portfolio Builder will choose from a group of globally diversified funds to allocate a user’s money. Those who are conservative or moderate investors are likely to have more bonds in their portfolio, while aggressive investors are likely to have more stocks. If users decide they don’t want to go with the Portfolio Builder’s suggested portfolio, they can opt-out of it. If users do like some of the investments it advised them to add, they can always make note of them and add them in when they’re creating their portfolios themselves. As a reminder, Stash does not rebalance portfolios or otherwise manage Stash Accounts for users on a discretionary basis.Auto-Stash

Stash offers a suite of automated savings and investing tools called Auto-Stash. Users can opt into these features, all of which are designed to help them make regular contributions towards their various financial goals.- Set Schedule allows you to automatically transfer money into your Stash accounts (brokerage accounts) on a recurring basis. You can also use Set Schedule to automatically invest your transferred money in a specific investment, or you can set it to place the money in your cash balance (uninvested money in your Stash account).

- Users can link an external funding account (i.e. a checking account) to their Stash account and activate Round-Ups for it. Whenever they spend with the debit card associated with their linked account, Stash will round up the transaction to the nearest dollar and deposit the difference into their Stash investment account.

- The Smart Stash tool helps users save even more money. It analyzes peoples’ earning and spending patterns from their linked external bank account to find whatever spare cash they can afford to save after all their recurring expenses have been paid. Users can set up maximum automatic transfer amounts of $5, $10 and $25 that get added to their Stash cash balance to then use to start investing.

Educational Resources

Stash provides an easy to understand analysis of each stock and ETF it offers to users so they can quickly examine things like risk, dividend yield, and expense ratios and a fund or company’s stock performance over the last 15 years.Security & Protection

Stash Investments, LLC is a registered investment advisor with the US Securities Exchange Commission (SEC).3 As far as securing its user’s private information, the app uses 256-bit bank-grade encryption and secure sockets layer (SSL). Also of note, it does not store its users’ bank login information. Investments are held by a custodian, Apex Clearing Corporation, a third-party SEC registered broker-dealer and member 0f the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). Apex Clearing’s SIPC membership means the investments in a brokerage account are protected up to $500,000 total (including $250,000 for claims for cash).4 Uninvested cash (through a brokerage account), is enrolled in the Apex FDIC-insured Sweep Program. Deposits to the Sweep Program are covered by FDIC insurance up to a $250,000 limit per customer at each FDIC-insured bank that participates in the Sweep Program. Once your cash is deposited with the participating banks under the Sweep Program, such cash will no longer be covered by SIPC. Stash Banking accounts2 are protected under Green Dot Bank’s FDIC-insured status.Customer Support

Stash offers its users phone, messaging (through its website) and email support. Phone support is available Monday through Friday, 8:30 a.m. to 6:30 p.m. EST, and Saturday through Sunday, 11 a.m. to 5 p.m. EST.How Much Does Stash Cost?

- Stash Beginner is $1 per month and gives customers a personal brokerage account and access to banking services, including the Stash debit card.

- Stash Growth is $3 per month and gives customers a brokerage account, retirement account and access to banking services, including the Stash debit card.

- Stash+ is $9 per month and gives customers a brokerage account, retirement account, two custodial investment accounts for minors, access to banking services, including the Stash debit card, and a monthly market insight report.

Signing Up & Navigating The App

Getting started with Stash only takes a couple of minutes. Users start by providing their email and creating a password for their account. Then they’ll be prompted to supply their name, date of birth, phone number and create a four-digit security passcode. From there, Stash works to understand a user’s financial situation and goals and their level of investing experience. Stash will ask what kind of investor a user imagines themselves being—conservative, moderate or aggressive. The questions that follow help Stash get an understanding of a user’s financial situation so that it can adequately advise and support users during their investing journey with the app. They’ll be asked about their employment status, what type of work they do, how much income they earn and their approximate net worth, when they think they’ll use the money they’re investing, their marital status, if they have kids or own a home, their level of investing experience, if they have a retirement account, and more. It seems like a lot, but it’s actually pretty easy to sail through these questions.

After that, users can decide how much they would like to invest each week or they can choose to make a one-time investment.

Then users start to choose their investment mix–choosing between Stash’s offerings of stocks and ETFs.

From there, users are asked to link their bank account to pull the initial investment and the app’s fees from.

That’s it, after that, the sign-up process is done.

Once signed up, whenever users open up the app, they’ll be in the “Home” tab where they get an overview of their account activity. They’ll be able to see the total value of their investments and cash in all of their Stash accounts. So, if a user has an investment account, a Stash Banking account, and a retirement account, they’ll be able to see the complete total of all three of those accounts. Users will also be able to see the total value of their investment portfolio and the amount of money in their Stash Banking account separately.

In the “Spend” tab, users can manage their Stash Banking account and see its activity. In the “Invest” tab, they can explore both individual company stock and ETF options. In the “Auto-Stash” tab, they’ll be able to manage all of the automated savings and investing features of the app. In the “Learn” tab, they can access the app’s full library of educational materials.

The questions that follow help Stash get an understanding of a user’s financial situation so that it can adequately advise and support users during their investing journey with the app. They’ll be asked about their employment status, what type of work they do, how much income they earn and their approximate net worth, when they think they’ll use the money they’re investing, their marital status, if they have kids or own a home, their level of investing experience, if they have a retirement account, and more. It seems like a lot, but it’s actually pretty easy to sail through these questions.

After that, users can decide how much they would like to invest each week or they can choose to make a one-time investment.

Then users start to choose their investment mix–choosing between Stash’s offerings of stocks and ETFs.

From there, users are asked to link their bank account to pull the initial investment and the app’s fees from.

That’s it, after that, the sign-up process is done.

Once signed up, whenever users open up the app, they’ll be in the “Home” tab where they get an overview of their account activity. They’ll be able to see the total value of their investments and cash in all of their Stash accounts. So, if a user has an investment account, a Stash Banking account, and a retirement account, they’ll be able to see the complete total of all three of those accounts. Users will also be able to see the total value of their investment portfolio and the amount of money in their Stash Banking account separately.

In the “Spend” tab, users can manage their Stash Banking account and see its activity. In the “Invest” tab, they can explore both individual company stock and ETF options. In the “Auto-Stash” tab, they’ll be able to manage all of the automated savings and investing features of the app. In the “Learn” tab, they can access the app’s full library of educational materials.

Where Stash Shines

Affordable Investing: Many larger brokerages require minimum account balances in the hundreds or even the thousands. With Stash’s no account minimum and fractional shares offerings, Stash is making it easy for anyone to start investing. For instance, Stash users can invest in trillion-dollar companies like Amazon and Google with just $1. Portfolio Guidance: When a new account is created, Stash provides guidance to help users build their portfolio from scratch. It offers up a list of suggested ETFs specific to a user’s indicated risk tolerance, even pointing out which investment it believes should make up the majority of someone’s asset allocation and supporting investments that diversify a person’s portfolio. Automated Investing And Banking: Stash also offers a “set it and forget it” approach with its automated investing and banking features to help users easily stay on top of their investing and savings goals. Users can set up recurring money transfers into their investment account and their Stash cash balance for the purpose of saving and using money to invest. These features help users unite their financial goals with their money-growing efforts. Thematic & Impact Investing: Stash’s thematic investing enables users to make investment decisions based on their values, principals and personal interests. Interested in investing in AI technology or companies that have a positive impact on society or the environment? Stash has an ETF fund for you. Education: Stash is all about teaching — helping those new to investing learn how to invest and those with some experience to invest better. This app makes it easy for all users to understand the most complicated investing and financial concepts. Its wide-ranging educational materials can be easily accessed through the app (or the Stash website), and it even provides tailored lessons to each investor based on their personal finances, investing goals and risk comfort.

Is Stash The Best Investment App For You?

We recommend this investing platform for a few reasons: The app is versatile catering to both beginner and experienced investors through its many features. New investors and those with limited resources can enjoy a low account minimum to start investing in fractional shares. More experienced investors who prefer to be completely in control of their accounts can appreciate the portfolio self-management aspect of the app and its diverse selection of investments. Stash has a variety of tools and features to help investors at all levels invest more efficiently like its banking and goal setting “Auto-Stash” features. The app does a great job of breaking down investment options, and its focus on long-term investing makes it ideal for building lasting wealth. Also of note, its educational resources are pretty much unmatched in this space. It’s important to note if you are considering Stash that it isn’t actively involved in managing its users’ portfolios in the way that other robo-advisor investment apps would be. It is also important to note a piece of fine print to pay attention to — that the app asks users to commit to regularly contributing a certain amount to Stash during the sign-up process. This is something users can easily opt-out of, though. Overall The App Is Best For:- Beginner and smaller investors

- Experienced investors who want to invest more efficiently

- Investors looking to save on investment account management

- Those looking to invest long-term

Footnotes