Sunbit Review – Pros and Cons in 2025

Americans only saved 4.4% of their disposable income in 2022.

This means most people probably don’t have a rainy day fund.

So, if your car breaks down and you need it to get to work, you might not have the money to fix it.

Luckily, Sunbit can help.

Below, I share my full Sunbit review. I’ll look at how you can use Sunbit to pay for unexpected expenditures and more!

What is Sunbit?

Sunbit is a buy now, pay later technology that allows you to choose from flexible payment plans to pay back over time.

You can borrow now and pay later for purchases like:

- Dental care

- Eye care

- Auto repairs

- Home repairs

- Veterinary bills

Sunbit lets you borrow up to $20,000 for payment plans over 3, 6, or 12-month periods. Dental care plans can range up to a 72-month repayment period.

Interest rates depend on your credit score but can range from 0% to 35.99% APR (Annual Percentage Rate). However, APR ranges may vary based on which state you live in.

Sunbit also offers an invitation-only Sunbit card to qualifying users. This can be used wherever a Visa card is accepted.

On their website, Sunbit describes their service this way, “We approve 90% of people who apply with fair, transparent rates and no late fees, origination fees, or penalties. Sunbit is the kind, kind of payment.”

This means most people who apply get approved, which makes this a great option if you need extra money fast!

How To Use Sunbit

Signing up for Sunbit is quick and easy.

Below is a three-step guide to get started with Sunbit:

- Apply for an account

- Check your options

- Confirm your loan

Step 1: Apply for an Account

To sign up for Sunbit, visit any participating merchant, and they’ll help you set up an account.

Participating merchants typically include local car dealerships, dental offices, repair companies, and eyewear stores. Sunbit’s website lets users search based on their location to find retailers closest to you.

The sign up process is painless.

You receive an email with a special Sunbit link and the Sunbit app asks you to scan your driver’s license or state-issued ID.

From here, submit your email address and phone number while confirming your full name, street address, and date of birth.

Step 2: Check Your Options

After entering your personal information, you’ll receive feedback within seconds. Getting a personal loan is quite easy as Sunbit approves 90% of applicants.

But remember that this does NOT mean approval is guaranteed. If you’re struggling to get approved, focus on increasing your credit score and settling debts you already owe.

Once approved, you’ll find a preliminary total that you qualify for. Below this figure, you’ll enter in the amount that you’d like to borrow.

You’ll see financing repayment options next. Once you choose a payment plan, the app presents you with information like:

- Your interest rate and APR

- Due dates for each payment

- The down payment amount

Next, you’ll enter your card information for your down payment before moving on to the last step.

Step 3: Confirm Your Loan

Before finalizing the application, carefully read through the digital Sunbit personal loan agreement.

This contract contains all the essential information about your loan like the agreed upon interest rate, monthly installment timeline, and any special terms and conditions.

Although you’ve confirmed your loan details in the app, you want to double check the contract for any errors.

Once you’ve agreed to the terms and conditions, sign the document, and enjoy your purchase!

Is Sunbit Legit?

Sunbit is a legit buy now, pay later provider.

It has 4.7 stars on Trustpilot and 4.6 stars on Google Play.

Sunbit is also partnered with Transportation Alliance Bank. This is good, because it means your loans are backed by a bank.

But keep in mind that according to Sunbit’s consumer privacy terms, Sunbit can sell personal identifiers like your demographic information, internet application, and network activity to third parties.

These third parties include data brokers, social media networks, and advertisers. But don’t stress because these firms aren’t malicious. They are just looking to send you personalized ads.

Is Sunbit Safe?

Sunbit is a safe and secure financial institution based in Los Angeles, California.

Also, they ask you to authenticate your identity before completing purchases. This helps to prevent fraudulent activities.

In addition, they implement strict physical and technical security measures to protect customer data. So, you won’t have to worry about your data falling into the wrong hands.

Sunbit Reviews

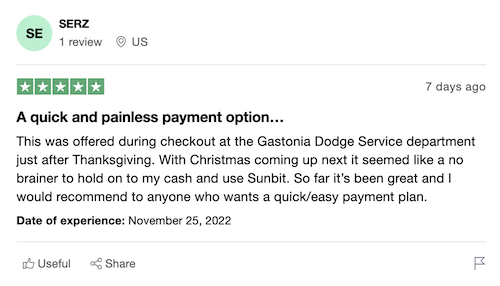

Here’s a review on Trustpilot from a customer who fixed their car using Sunbit. This allowed them to hold on to their money and buy Christmas gifts.

Source: Trustpilot

Sunbit also provides several Sunbit reviews and case studies on their website.

Source: Sunbit

For example, Schepree Miles (pictured above), a mother of a special needs child, used Sunbit to pay for dental treatment. It prevented her from having sleepless nights because instead of paying for the procedure in full, she was able to split up her total over multiple months.

Source: Sunbit

There’s even a Sunbit review from Darren Boggs, CEO of Altius Healthcare Management, who increased sales seven times over after offering Sunbit to his customers.

Countless Sunbit reviews also talk about how straightforward the app is.

Source: Google Play Store

But I did notice a Sunbit review complaining about the customer service. The user said it’s difficult to get through to the customer support team, so this is something to keep in mind before signing up.

Source: Google Play

I recommend walking into a store that offers Sunbit and completing the sign up process there. This way, if you run into any issues, the merchant can lend you a hand.

Commonly Asked Questions About Sunbit

How Do I Apply For A Sunbit Credit Card?

The Sunbit card is a by-invitation-only credit card, so you can’t apply for one. However, you can request to join the invitation list by visiting the Sunbit website and entering your full name and email address.

What Credit Score Is Needed For A Sunbit Loan?

Sunbit doesn’t have minimum credit score requirements, but its website states that they approve 90% of applicants. They do not run a hard credit check when applying.

Where Can I Use My Sunbit Credit Card?

If Sunbit invites you to use their credit card, you can shop anywhere Visa is accepted. But with traditional Sunbit loans, you can only visit partnership stores like local car dealerships or dental offices. If you want a complete list of vendors that work with Sunbit, head to the Sunbit shop directory.

Sunbit Credit Card Limit?

The maximum amount you can borrow from Sunbit at once is $20,000. However, this amount is not guaranteed and can vary from customer to customer.

What Is Sunbit Used For?

You can use Sunbit to pay for everyday expenses or unexpected emergencies such as car problems, dental care, eye care, or expensive pet treatments. All without penalties, late fees, or origination fees. This makes it perfect if you want to make a large bill more manageable.

Does Sunbit Affect Credit Score?

Applying for a Sunbit loan doesn’t affect your credit because they only run a soft credit check. But Sunbit does report payments to credit bureaus. If you’re making payments on time, this will build your credit score. If not, it will look bad on your credit report.

If you need help fixing your credit, check out our comparison of Credit Saint vs Lexington Law, or see if working with the best tradeline companies could be the right credit repair solution for you.

Meanwhile, learn how to budget for non recurring expenses so you can be prepared for unexpected costs going forward.

If you’re looking for a low-tech, hands-on budgeting method, learn about cash envelope categories. And if you need to boost your savings fast, the 60/30/10 rule budget can help.

To learn which budgeting app could best help you manage your finances and boost your savings, check out these comparisons of Rocket Money vs the competition:

Then use a net worth tracker to see how your new financial strategies are paying off.

Is Sunbit Hard To Get Approved?

Sunbit states that they accept 90% of people that apply for a loan. So, getting approved isn’t hard. If for some reason your application is denied, try working on your credit score by paying off debt or settling old accounts.

What Happens If I Don’t Pay Sunbit?

If you don’t pay your Sunbit balance, you’ll get one free due date change per purchase. If you’re still missing payments, Sunbit will report your account to the credit bureaus. This can hurt your credit score. So even though there aren’t late fees, I suggest always paying your bill on time.

Can I Use Sunbit Credit Card Anywhere?

You can use your Sunbit credit card at any store that accepts Visa. But don’t confuse this with traditional Sunbit loans, which are only available at select service providers in the US. Common examples are dentists, vets, eye care professionals, and auto repair stores.

What Are Sunbit Alternatives?

- Sezzle (read full Sezzle review here)

- Perpay (read this full PerPay review to learn more)

- Afterpay (read these Afterpay reviews to learn more)

- Affirm (read these Affirm reviews to learn more)

- Zilch (read this full Zilch review to learn more)

- Nelo (read this Nelo review to learn more)

- Klarna (read these Klarna reviews to learn more)

- Zip (read these Zip reviews)

- PayPal Pay in 4 (read these PayPal Pay in 4 reviews to learn more)

- Splitit (read this Splitit review to learn more)

- Apple Pay Later (read this Apple Pay Later review to learn more)